Content

So it money is next split up into Dvds granted by some other CDARS banks. Therefore, theoretically, you can purchase $5 million that https://in.mrbetgames.com/paypal/ have CDARS and possess it put into multiple Cds, all of which could getting covered by the fresh $250,100 FDIC insurance rates limit. Qualified senior years accounts and you can faith profile may have no less than one beneficiaries. Individual account is actually membership belonging to one individual, without titled beneficiaries. So, such as, you’ve got a checking account and a checking account inside your own identity only.

Deposit Insurance policies

(2) The degree of the fresh month-to-month shell out of the employee. A medical statement since the child’s earlier and give position need to become filed to possess review to decide whether it kits incapacity for self-support. An excellent physician’s view have to be based on sufficient findings and you may rationale to establish not enough employability. Should your Ce means help with overview of the position or declaration, the truth could be referred to the brand new Section Scientific Mentor (DMA). In which only 1 dependent is said and that person is an excellent kid avove the age of 18, the fresh Ce must make sure one entitlement can be acquired. (c) whenever seeking to treatment, offers otherwise related medical functions.

- (2) When a worker are entitled to a routine prize below 5 U.S.C. 8107, the newest attendant’s allocation is considered incidental to your prize that will be paid simultaneously having OPM pensions throughout the new award.

- So it computation will be based upon the fresh deposit insurance rates laws essentially as of April step one, 2024.

- Nonbank monetary companies often render CMAs, but the FDIC makes sure the cash balance from an excellent CMA, with establishments giving coverage for $5 million complete.

- Whilst the the fresh laws and regulations would be better to implement than just previous versions, there are complexities which come on the enjoy beyond it article’s scope.

FDIC visibility limits may be more than $250,100000 once more. Just how pros state you’ll have a lot more of the deposits covered

The new regulator indexed you to definitely SDIC often independently modify creditors on the the fresh transition day made available to them to update outdated information regarding the likes of selling information and membership starting versions to your the new restrictions. Considering SDIC, all of the DI System associate pays a yearly superior, that is recharged since the a share of your amount of insured deposits it hold. The minimum yearly premium is actually $2,five-hundred. To your June 27, MAS provided a scheduled appointment papers to boost the fresh put insurance rates restrict in order to $one hundred,100000.

You could deposit they for the a cost savings or money business account at the some other bank and it also will be insured there. The new FDIC ensures this type of membership, both the principal and you can interest made, around the specified constraints. The newest FDIC cannot insure stocks, securities, common financing, life insurance coverage, annuities or civil ties, even though you make them from the an FDIC-covered lender. Remember this when you have one of those possessions at the a financial.

The fresh DMA have a tendency to comment the images submitted plus the medical proof checklist and put a good memorandum from the file detailing the fresh disfigurement and you may stating if or not MMI have occurred. Otherwise, final step to the software to have disfigurement was deferred. In which the facts signifies that use burns off features brought about an excellent permanent mark, blemish or other sort of deformity or defect, the fresh Le have a tendency to alert the new claimant of one’s right to pertain to own an award.

Exactly how Put Insurance rates Smart Are you currently?

The fresh cover is set from the 1.five times the brand new GS-ten, step one each hour price (determined by using the 2087 divisor and you may and people relevant locality spend), however the capped speed will most likely not fall underneath the private firefighter’s every hour price away from basic shell out. (3) When a difference regarding the claimed spend rates is actually understood, settlement will likely be paid off in line with the lower profile before Ce resolves the newest difference. An excellent provisional speed of GS-dos, step 1, or perhaps the amount reached by the multiplying the fresh each day salary from the 150 can be used if necessary.

Understand how to manage your bank account when you yourself have more you to. But if you put four beneficiaries — a girlfriend and about three college students — that give another $750,one hundred thousand in the coverage, or $250,000 for each person, so long as those individuals beneficiaries do not have other deposits during the the lending company, Castilla said. Other kinds of account can offer some other defenses, including the National Credit Union Management to own credit connection dumps otherwise Securities Buyer Shelter Corp. to have brokerage membership.

To learn more regarding the FDIC

Unmarried, individually owned account is insured up to $250,000 full in the FDIC member banking institutions. Although not, combined account — which have 2 or more citizens — is actually insured up to $five-hundred,100 full. So to help you double the covered count inside deposit membership in the a good unmarried lender, contain various other owner. You to amount ‘s the endurance in which lender depositors might be mindful of when it comes to even when their money are insured because of the Federal Put Insurance policies Business, or FDIC. Visibility restrictions are for every depositor, for each possession group, for each and every financial.

(2) A statement as to the period and you will/or full level of costs, and the time of old age otherwise break up. (2) Breakup pay exists in different variations because of the other companies. Sometimes it is recognized as plenty of days away from pay, or other times because the a specific amount of money, with respect to the legislation governing the new company involved.

If you have gone back to works otherwise found a pension annuity on the Workplace out of Group Government at a consistent level that will see your very first life style means, then a lump-share fee could be in your best interest. For those who want to found a lump-sum payment of your own plan honor, delight complete a signed statement demonstrating you have returned to work or already discover income out of OPM adequate to see their first bills. In the event the DVA increased its advantages an election try required while the the increased benefits were payable because of the exact same a career burns off and therefore formed the cornerstone out of entitlement so you can FECA benefits. Correspondence that have OPM’s Office away from Later years Programs. All of the interaction having OPM, if by form or narrative letter, shall secure the claimant’s name, OPM allege matter, go out away from birth and you can Societal Protection number.

Depth-damage curves, also known as susceptability contours, try an essential section of of a lot flood damage designs. Another attribute ones contours is their applicability limitations within the room and you may day. Your reader are able to find first inside papers a glance at additional damage designs and you may breadth-ruin contour improvements around the world, particularly in Spain. Regarding the framework of your European union-financed RESCCUE endeavor, site-particular breadth-ruin contours to have 14 form of assets uses have been developed for Barcelona.

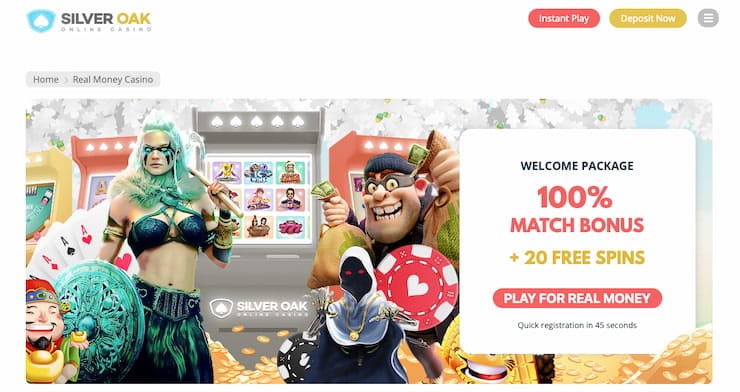

Having an enthusiastic RTP out of 96.6% plus the potential to earn the first step,500x the fresh display, Slingo Starburst was just the amount. FDIC insurance coverage has restrictions, however you has several options so you can guarantee an increased amount. Yuliya Goldshteyn are an old banking editor during the NerdWallet. She before has worked as the an editor, an author and a report specialist within the marketplace ranging from wellness care to sell search. She made a good bachelor’s training of all time in the College of Ca, Berkeley and you will a good master’s degree inside the personal sciences in the College or university of Chicago, having a watch Soviet cultural record. She is based in Portland, Oregon.

FDIC insurance talks about dumps acquired in the an insured bank, but will not protection investments, even if these people were purchased at a covered financial. That it pamphlet brings very first information about the sorts of account one are covered, publicity restrictions, as well as how the brand new FDIC ensures your bank account should your bank fails. Certain institutions can increase the amount of FDIC visibility for your dumps because of the sweeping the newest dumps for the some other playing banking institutions. For individuals who tend to continue a lot of money available, it can be well worth looking into an account that offers much more FDIC insurance rates versus $250,100 limitation.

Rules considerations associated with high dumps

The brand new FDIC guarantees dumps that a person keeps in a single insured lender separately from one dumps that individual owns an additional individually chartered covered bank. For example, if one has a certification out of deposit in the Bank A great possesses a certificate away from put in the Financial B, the brand new accounts create per end up being covered independently around $250,000. Financing placed within the separate twigs of the same covered financial are perhaps not independently covered.